Some Ideas on Senior Whole Life Insurance You Need To Know

Table of ContentsThe Term Life Insurance DiariesGetting The Senior Whole Life Insurance To WorkExamine This Report on Life Insurance Companies Near MeThe Buzz on American Income Life

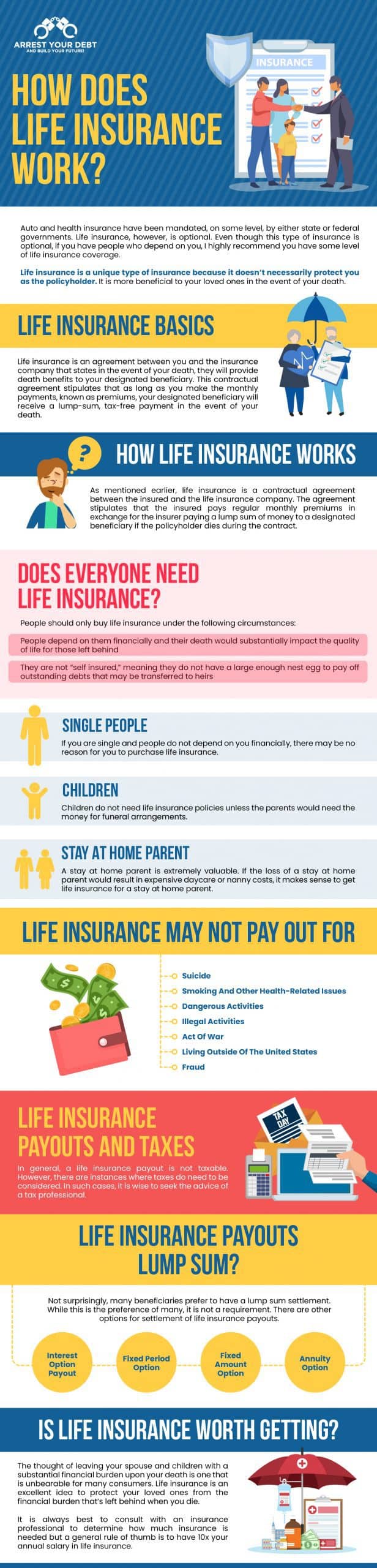

Life insurance coverage essentials: Terms, protection needs and also expense, Life insurance policy policies can differ widely. Even with all those differences, most plans have some common attributes. Right here are some life insurance policy essentials to help you much better recognize how coverage functions. Whole life insurance.For term life policies, these cover the cost of your insurance coverage and administrative expenses. With a long-term plan, you'll additionally be able to pay cash into a cash-value account.

That requires life insurance coverage? Like all insurance coverage, life insurance policy was created to address a monetary issue.

The 5-Minute Rule for Life Insurance

If you have a spouse, youngsters or anybody depending on you monetarily, they're going to be left without support - Cancer life Insurance. Even if nobody relies on your earnings, there will certainly still be expenses related to your fatality. That can imply your partner, child or loved ones will have to pay for interment and other end-of-life costs.

If no person depends on your income as well as your funeral service expenditures will not damage anybody's funds, life insurance may be a point you can skip. Yet if your death will certainly be an economic concern on your loved ones quickly or in the long term, you might require a life insurance coverage plan.

If you're just covering end-of-life expenditures, you will not need as high as if you're trying to change lost revenue. The calculator listed below can assist you estimate just how much life insurance policy you need. If you want an irreversible policy, connect with a fee-only monetary advisor. The advisor can help you comprehend exactly how a life insurance policy suits your economic plan.

Healthier individuals are less likely to die soon, which implies business can bill them less permanently insurance. Younger individuals are additionally less most likely to pass away soon, so life insurance policy is more affordable (typically) for younger customers (Whole life insurance). Ladies live longer, nonsmokers live longer, people without complicated medical issues live much longer, et cetera goes the list.

The Main Principles Of Cancer Life Insurance

The insurer will check your weight, blood pressure, cholesterol as well as various other elements to attempt to identify your general health., yet you'll typically pay more for protection. You might additionally be limited to much less coverage than you're wishing for, with some larger insurers maxing out no-exam plans at $50,000.

Staff member life insurance policy can typically cover standard end-of-life costs and also may cover some or all of your annual income. Standard protection typically doesn't require an exam as well as might also be cost-free.

Life insurance policy is a kind of insurance policy that pays a beneficiary in case of the fatality of the insured person. When a plan is acquired, a details fatality advantage is picked. Life insurance policy is an agreement between the policy owner and also the insurance provider: the plan owner (or policy payer) agrees to pay a specified amount called a premium.

The Basic Principles Of Life Insurance

If there are individuals who depend on you monetarily (including youngsters, a partner, a service partner, disabled or senior family members), having a life here insurance policy policy will certainly secure them when they can no more trust your revenues. If you have a home mortgage or various other financial commitments, a life insurance policy plan can assist repay financial debts and also offer living costs to individuals you call as beneficiaries.

For lots of people, the requirement for life insurance will certainly be greatest after beginning a family members and will reduce over time as children mature and also end up being independent (Life insurance company). Life insurance policy can help see to it future needs are met which your household keeps its standard of life, regardless of what life brings.

Keep in mind to include the future expenses of items you want to pay for such as a home mortgage or educational expenses. Some advisors recommend a quantity of life insurance that equates to or exceeds two to 6 times the annual revenue of the policyholder.

What are different sorts of Life insurance policy? The main objective of life insurance policy is to offer dependents ought to the family service provider die - Term life insurance Louisville. However, there are distinctions in kinds of insurance that allow various advantages and also risks. Some kinds of life insurance coverage are for a specific "term" or period of time.